In recent years, there have been numerous websites attempting to scam individuals through deceptive debt collection practices.

One such company is Unifin which claims to be a financial organization but scams people as a debt collector.

Continue reading to learn more about the Unifin Debt Collector scam.

Table of Contents Show

What Is Unifin Debt Collector Scam?

A Unifin debt collector scam is a type of fraud where scammers pretend to be from Unifin, a legitimate debt collection agency.

Further, they try to get money or personal information from various people through texts or calls.

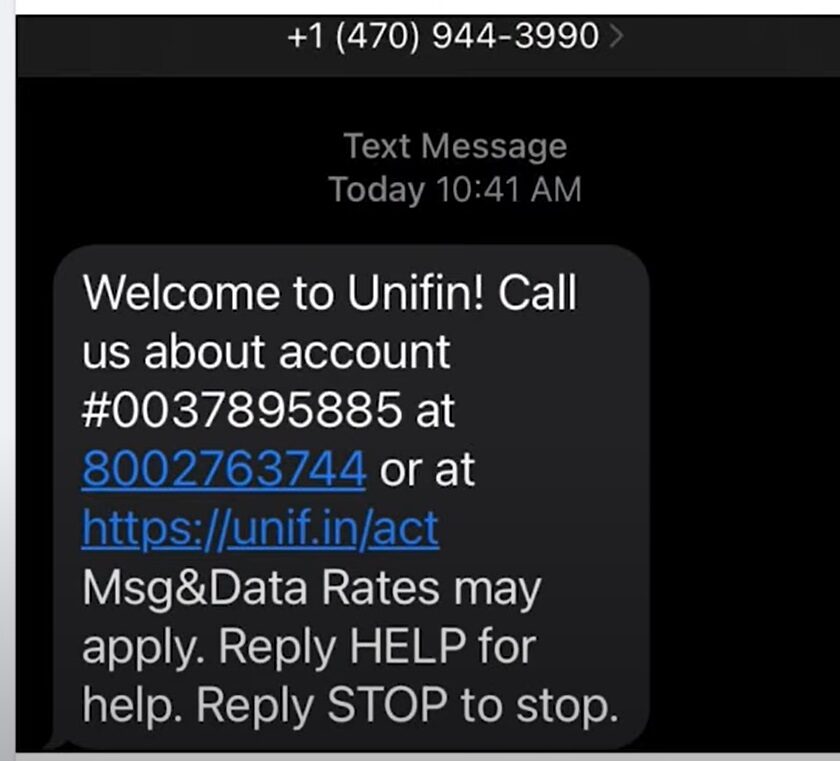

The scammers can use text messages, phone calls, or fake websites to contact the potential victims.

Unifin pressures individuals via text messages to pay debts that may not be owed or exist.

Further, they may also use fraudulent links to steal crucial personal information from users such as bank details.

When users open the fraudulent website, it asks to enter critical information such as SSN, DOB, and full name.

No legitimate website asks for these information while logging in.

What To Do After You Fell For Unifin Debt Collector Scam?

When you unknowingly fall for a scam, there are certain measures you can take to protect your finances.

Here are some things that you can do if you feel for the Unifin Scam:

1. Credit Freeze

The credit freeze will stop anybody from trying to take out loans, opening bank accounts, applying for credit cards, etc. in your name.

Furthermore, this action will prevent the creditors from having access to the credit report.

And this will prevent approval of new credit accounts in your name, whether they are fraudulent or legitimate.

2. Contact Bank

You can Contact your bank or credit card company and inform them of the fraudulent transaction.

Further, ask them to reverse the payment, cancel your card, and issue a new one.

Then, you may also need to change your account passwords and PINs if you have shared them with the scammers.

3. Report Identity Theft

If you suspect that a fake debt collector has contacted you, report it to the authorities.

You can also report any suspicious or harassing contacts to the appropriate authorities such as the Federal Trade Commission.

Then, file a complaint with them to get a proper recovery plan.

In addition, to prevent further fraud, block the phone number and email of the scammer.

How To Avoid Falling Victim For The Unifin Debt Collector Scam?

Users can avoid falling for such scams if they take some precautions.

Taking certain measures can help protect against fraudulent activity. Some measures are:

1. Verify The Identity

To avoid falling for these scams, you should always verify the identity and legitimacy of any debt collector.

Always make sure to verify before you make any payments or share any information.

Further, you can also contact Unifin directly to verify if they have any legitimate business with you.

2. Don’t Share Financial Information

You should never share your personal or financial information with anyone who contacts you unsolicited.

This includes your bank account, credit card, social security number, or any other sensitive data.

Since Scammers may use this information to steal your identity or money, you have to be cautious.

The Bottom Line

The Unifin Debt Collector scam is a type of fraud targeting people claiming to collect debts from them.

The scammers use fake texts and calls to ask for immediate payment for non-existent debts.

Moreover, users should be self-aware about such fraudulent websites and refrain from sharing any sensitive information.