After 16 years of helping people track their spending, budgeting, and saving, Mint is saying goodbye.

How can Mint users migrate their data and find alternative solutions?

Mint’s shutdown in the personal finance app market is affecting millions of users who rely on it for managing their money. However, many other apps offer similar or even better features and services; such as Debitum, GreenStash, and Tiller Money.

Continue reading to learn why Mint is shutting down and what are its alternatives.

Table of Contents Show

The Mint Controversy

Mint, a personal finance app, is shutting down by the start of 2024.

Relying on the web news, Mint was acquired by Intuit in 2009.

Since then, it is struggling to cover its data costs with its ad-based business model.

Intuit is now asking Mint users to switch to Credit Karma, another personal finance app it acquired in 2020.

Credit Karma offers similar features to Mint, such as budgeting and spending tracking.

Further, it also hopes to attract more high-score customers.

Some Mint users are unhappy with this decision, as they have many years of financial history stored in the app.

In contrast, they do not want to lose access to it.

What Are The Alternatives To Mint?

If you are a Mint user, you may want to consider your options before the app is closed down.

You can either migrate to Credit Karma or look for other alternatives that suit your needs.

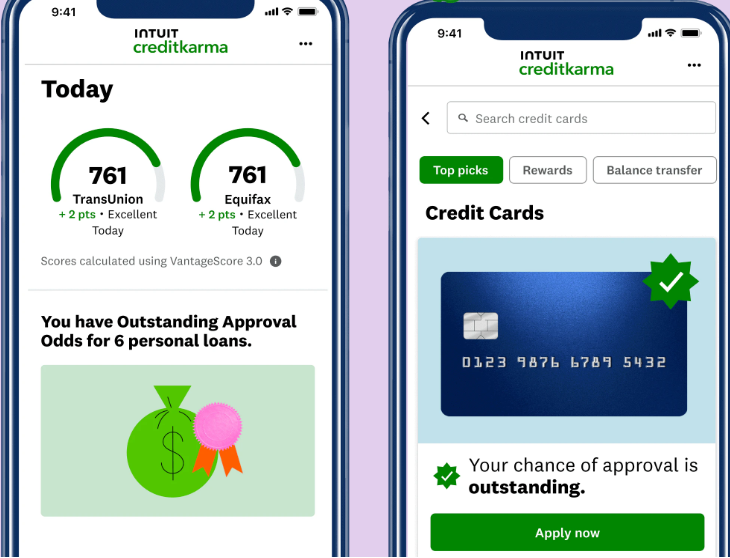

Credit Karma

As Intuit is asking the Mint users to use Credit Karma, they need to transfer the whole data from Mint to Credit Karma.

However, there is no direct way to migrate your data from Mint to Credit Karma.

Instead, you can download their Mint data and link external bank accounts to your Credit Karma Money Spend and Save accounts.

1. Download Mint Data

To download Mint data, users must visit Credit Karma’s U.S. Help Center and follow the instructions there.

Moreover, you can export your transactions, budgets, trends, goals, and net worth data as CSV files.

2. Link External Bank Accounts

Users can only link one external bank account at a time to their Credit Karma Money Spend and Save accounts.

They can change your linked bank account up to 4 times.

The name on their external account must match the name on their Credit Karma Money Spend and Save accounts to link the accounts.

Additionally, they can link to a joint account as long as your name is one of those listed on the joint account.

To link external bank accounts to the Credit Karma Money Spend and Save accounts; follow the steps below:

- From their Credit Karma Money Spend or Save home screen, select Make a deposit.

- Select Continue on the screen that says “Credit Karma uses Plaid to link your bank.”

- Find your bank by selecting its logo or by using Search.

- Log in with your online banking username and password.

- Choose which account you’d like to connect to if you have multiple accounts at this institution.

- Once your external account is linked to your Credit Karma Money Spend and Save accounts, you can start making deposits.

They must use Plaid, a third-party service, to securely connect their bank accounts.

Moreover, they will need your online banking username and password.

Some More Alternatives To Mint

Instead of Intuit, if you want to use another finance app, you can try the best alternatives to Mint.

Here are some alternatives you might want to consider; however, you can choose one according to your preference.

1. Tiller Money

Tiller Money is a budgeting tool that uses spreadsheets to help you create and manage your budget.

It automatically updates your transactions daily and lets you customize your categories and reports.

You can try it free for the first month and then pay $79 per year.

2. Money Manager

Money Manager is a personal finance app that helps you track your income, expenses, assets, liabilities, and budgets.

It also supports multiple currencies, accounts, and categories.

You can sync your data across devices and export it to CSV or Excel files.

It is free to use with ads, or you can upgrade to the premium version for $3.99 per month or $39.99 per year.

3. GreenStash

The GreenStash is an investment app that helps you save and invest your spare change in a diversified portfolio of ETFs.

Further, it offers personalized advice, financial education, and goal-setting features.

You can start investing with as little as $5 and pay a flat fee of $1 per month for balances under $5,000 or 0.25% per year for balances over $5,000.

4. Debitum

Debitum is a debt management app that helps you pay off your debts faster and save money on interest.

It allows you to create a customized debt payoff plan, track progress, and get reminders and tips.

Additionally, you can compare different scenarios and see how much you can save by changing your payment strategy.

Contrarily, it is free to use for up to three debts, or you can upgrade to the pro version for $2.99 per month or $29.99 per year.

The Bottom Line

Mint has been a trusted and beloved companion for many people who want to take control of their finances.

However, Mint has also struggled to keep up with the evolving needs and expectations of its users.

Mint’s announcement to shut down is a shock for many, but it also creates a chance for new and better solutions to emerge.

Contrarily, Mint users should explore their options and find an app with the best features and functionality.