Accounting can be the most sedentary job where you sit behind the desk most of the time, but it does not mean the desk has to be in the office all the time!

Yes, like any remote job, Accountants can enjoy working from the comfort of their homes by setting up a dedicated workstation.

In general, Accountants can work from home as bookkeeping has predominantly moved from paper to computer and is mainly conducted through telecommuting, accounting/invoicing software, and relevant tools.

In fact, 97% of Accounts in the UK worked from home during the COVID lockdown, boosting chances of finding remote jobs.

Therefore, remote job opportunities for Accountants are higher than likely.

Read on to learn how to become a remote Accountant and what resources you need.

Table of Contents Show

Can Accountants Work From Home?

Accounting encompasses handling financial records and documentation, reviewing and analyzing data, preparing financial documents, and filing taxes for the smooth operation of any organization or entity.

Unlike other field jobs, Accountants enjoy sitting behind the desk running numbers.

In fact, it is one job that can be done from anywhere because much of Accounting work is digitized.

All you would need is a computer or laptop with a working internet connection, access to financial data, and relevant resources or tools.

About 1.3 million accountants and auditors are employed in the US (CPAs and non-CPAs), with 85% of professionals working in-office before the pandemic.

The study indicates that the number is expected to reach 47% in 2022, with over 50% of accountants working remotely.

In fact, there are a few benefits of being a remote Accountant.

- Less commute to the office means you can spend more time at your desk solving financial problems.

- It ensures reduced office costs, Accounting for electricity, sitting space, beverages, and materials.

- Remote work offers a chance to achieve a better work/life balance -An Accountant can pick their productive hour for labor.

- Increased flexibility means indulging in activities such as exercise, cooking, etc., to keep your daily schedule and mental health in check.

However, most firms seek Accountants to work in-office so they can work in a team, especially government and forensic Accountants.

Most private (non-CPAs) and CPAs (Certified Public Accountants) hold offices to meet clients and employ associates, requiring working in-office regularly.

Chartered, management, and Investment accountants would frequently work in different locations to accommodate their clients.

Many fresh Accountants would start their career path with firms to gain experience; however, some may find remote jobs.

Quick Tip: You can choose to work from anywhere as long as you find the desired job and have the education and experience.

Common Accounting Jobs you can do from Home

Accounting is a mostly desk job that rarely requires you to step outside; however, you may sometime need to meet the clients or pay a visit to government offices.

With so many different Accounting fields to choose from and a minimum package of $50,000 per annum, even many more are making their way into Accounting.

The accounting job is so promising that 72,923 graduates completed their master’s degree in Accounting in 2020.

However, finding a remote job can be difficult because not all employers allow work from home, especially government jobs.

Despite all the complexities, most experienced Accountants find ways to work remotely by telecommuting with the staff and clients on the go.

Here is the list of accounting jobs that may or may not offer remote work opportunities.

| Types | Specification | Benefits |

|---|---|---|

| Financial Accounting | 1. The process of recording, summarizing, and reporting transactions to prepare financial statements for public and private use. | 1. They receive about $56,280 per annum with benefits. 2. Financial Accountants are more likely to find remote jobs thanks to the nature of their work. |

| Governmental Accounting | 1. Accounting or bookkeeping government records and income/expedite of government bodies. 2. It is generally classified into three funds: governmental, proprietary, and fiduciary. | 1. They receive about $52,604 - $73,650 per annum. 2. Finding remote job is only possible through contracts provided to Accounting firms. |

| Public Accounting | 1. Public Accounting refer to providing Accounting services to other firms such as business or individuals who help a range of clients. | 1. They receive about $15,000 or more per annum. 2. Remote work opportunities are easily available. |

| Cost Accounting | 1. It refers to recording of all the costs incurred in a firm in a way that can be used to improve its management. 2. it is only done for internal purposes. | 1. The renumeration and remote job opportunity is similar to financial or management Accountant. |

| Forensic Accounting | 1. It combines Accounting with investigative techniques used to discover financial scams or frauds. 2. The Accounting reports are submitted to courts or the responsible body for auditing. | 1. They may receive about $107,000 per annum. 2. It offers chances to work remotely or in-office. |

| Tax Accounting | A subsector of Accounting that deals with preparing tax returns, tax payments, and filing taxes for individuals, businesses, and corporations. | 1. They will receive about $55,023 - $68,220 per annum. 2. Tax Accountants can work from home to provide CPA services to varied clients. |

| Auditing | 1. It involves financial statement audits or objective examination and evaluation of any firm's financial statement. 2. It is done by third-party Accountants, internal parties, and government entity such as IRS. | 1. They will receive about $59,390 per annum. 2. Many internal auditors work from home, while IRS auditors will work in-office. |

How to Become a Remote Accountant?

Accounting jobs will remain the same wherever you choose to work, but becoming a successful remote worker means better managing your work and privacy.

However, the first step to getting a well-paying remote job is to earn certifications and actively search for work.

Here are two crucial steps to becoming a remote Accountant.

Step 1: Qualification/Skills

One can apply for an Accounting job upon completing a degree in Accounting, Bachelor of Science in Accounting, or Chartered Accountancy, with a minimum of 120-125 hours.

The types of Accounting degrees include forensic, managerial, CPA, MBA in Accounting, etc.

However, Accounting jobs are classified into corporate, public, government, and forensic.

- CPA allows certification to find advanced Accounting jobs, while non-CPA jobs apply to different fields.

- Some Accounting jobs would require you to complete an ethics course or exams, such as CPA and tax Accounting.

- Similarly, earning a master’s degree in Accounting will further help to advance your career.

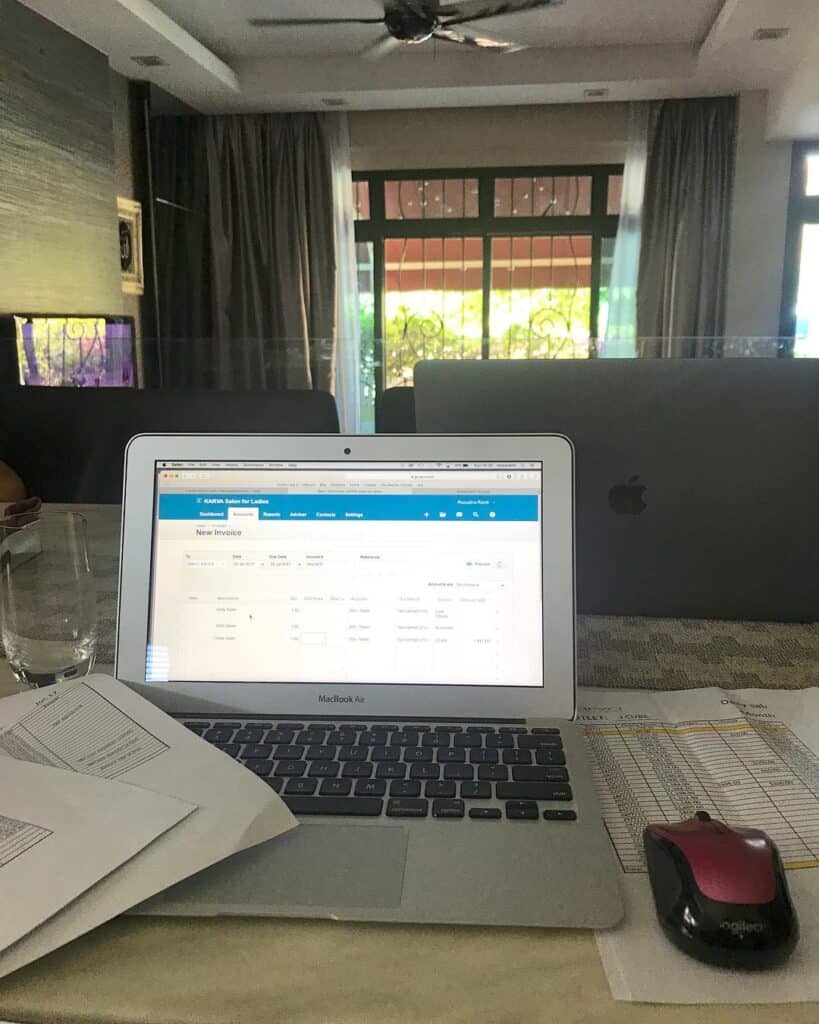

Remember, with Accounting jobs becoming digitized; you will be required to acquire software knowledge such as Freshbooks, Xero, FinancialForce, Sage, SAP, Netsuite ERP, BillQuick, Zoho Books, etc.

Step 2: Remote Job Search

Most students find internship jobs, paid or unpaid, to get valuable information about the field and help score higher wages and increased job opportunities.

Upon completing your degree, you should look for jobs that allow you to work remotely.

Most firms will want you to work in-office upon graduating to learn the trade before choosing to work remotely.

If you pay attention to most job vacancies and openings from the company, they would demand a few years of experience from an accountant.

Therefore, acquiring experience as an Accountant without working in-office may become impossible.

Here are some companies willing to offer you remote working jobs.

- All In One Accounting provides on- and off-site accounting to companies.

- Ignite Spot Accounting -A privately held accounting firm providing solutions to firms of all sizes.

- Supporting Strategies -An outsourcing agency for operational support and bookkeeping

- Aston Carter -A privately-held company by Stephen James Associates specializing in staffing.

- eXp Realty -An agent-owned, cloud-operated brokerage firm.

- CVS Health -A leading healthcare provider.

- Kforce -A staffing and recruiting firm that specializes in staffing solutions.

Tips to Work From Home as an Accountant

Being a remote Accountant does not mean running numbers or submitting reports; you need to be a proactive communicator, meet deadlines, use tools and software to their best, and find balance in work and private life.

You are expected to meet the employer’s primary conditions while striving to achieve more significant results and success.

Here are a few handy tips to prove your mettle as a successful remote Accountant.

1. Create a Dedicated Workstation

Any remote work would effectively start with a dedicated home office space or workstation.

The same goes with Accounting which requires you to sit through a lot of numbers, statements, and documents for hours.

Working out of bed or couch may not be healthy, especially for intensive Accounting work.

Find a spare room, set up a desk with a comfortable chair and computer, or turn a used room corner into a workstation.

Read more about setting up an office desk in your bedroom.

2. Communicate Proactively

Another crucial factor in becoming a practical remote Accountant is communicating proactively with clients and co-workers.

When working from home, you might feel as if you are intruding on others’ personal space by calling them at home.

However, your goal should be to remain active in communication with them. Telecommuting is your only option to stay in touch.

Use emails, phone calls, video chats, online chat software, and FTP (file transfer protocol) to share and exchange information on the go.

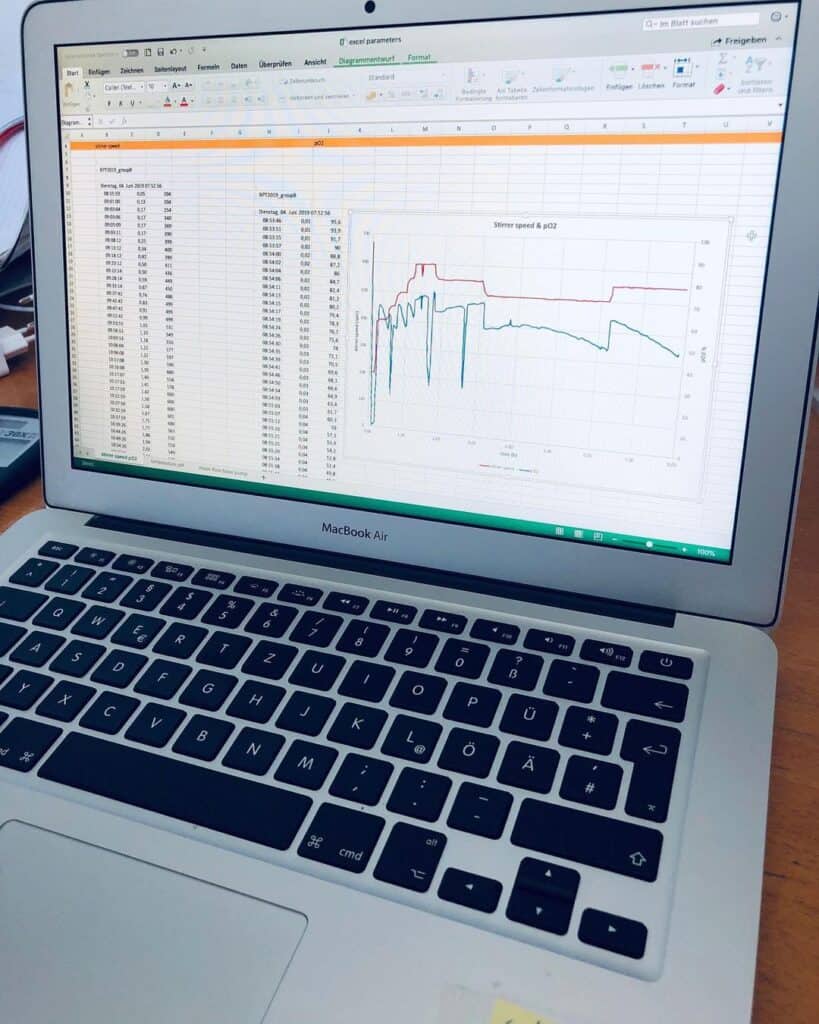

3. Become Tech-Savvy

An Accounting career involves a lot of calculations that are better done in software.

Being a remote Accountant, you must have access to relevant and certified tools to handle these calculations.

Accounting software is designed to minimize your work by creating invoices, statements, and reports using predesigned formats.

Some standard Accounting software includes Oracle NetSuite Accounting, FreshBooks, Zoho, Excel Sheet, and online bookkeeping or taxation apps.

You should be able to use the software in-sync with emails and FTP to exchange files pronto!

4. Display Professional Integrity

Working as a remote employee requires you to maintain personal and professional integrity.

Your employers and clients would trust you with sensitive details, which require keeping optimum secrecy.

You would need to password-protect your computer and apply multiple firewall layers to files, documents, and emails.

Similarly, you should store hardcopy of sensitive data in a safe locker with encryption and purge them once immediately upon completion.

Remember, buying a professional firewall and security software or app would require paying money, mostly out of pocket.

5. Use Task Lists and Time Management Tools

A successful remote worker will maintain their daily, weekly, or monthly schedule in advance and keep track of all the progress.

Therefore, maintaining task lists and time management tools becomes more than essential.

Create daily task lists using software like Todoist, TickTick, Microsoft To-Do, OmniFocus, etc.

Similarly, invest in time management tools to get the best out of your work hours.

Apps like Scoro, ActiveCollab, ProofHub, and TimeCamp would not only manage time but also set reminders, create daily planners, give the task a time limit, and block distractions.

6. Avoid Personal Tasks

Strictly avoid doing personal tasks during the predetermined work hours, as it will slow your progress and undermine your productivity.

All Accounting jobs usually come with deadlines and time limits; therefore, your primary task will be to complete it within the deadline.

Therefore, take frequent breaks in between to complete your household chores.

Otherwise, make a To-Do List for personal tasks and strictly stick to it to prevent impeding your work.

You will find some apps to manage your household chores, such as OurHome, Chore Pad, Homey, and Tody.

7. Display a Sense of Accountability

Taking an Accounting job means you must be accountable to your employer, clients, and co-workers.

You should be willing to take responsibility when you make mistakes and take a proactive approach to fix them, even by going out of your work hours.

Remote working may not always be smooth, and finding who is at fault may take longer.

Therefore, you should be able to make judgment calls from time to time and take steps to correct your mistakes.

Read more: 11 easy tips for not being Lazy when working from home

Starting Your Accounting Firm at Home

Accountants starting their firm may be a good idea to amass their clients and oversee their own business.

In fact, many experienced Accountants start private firms, especially CPAs, and financial and chartered accountants, after gaining enough insight and experience.

However, challenges are always looming if you have not owned a firm.

Here is what you need to know.

- Consider starting a private Accounting firm as long as you have clients to have a reliable source of income.

- Otherwise, amass necessary Accounting credentials, such as degrees, certifications, experience, and exposure, to make clients trust your firm.

- CPAs with insight into Accounting or those who have worked with experienced CPAs can also consider starting their firm.

- Becoming a partner with a fellow CPA to start a firm may also work well.

- Along with CPA, choose a different specialty, such as financial, forensic, or taxation, to bring diverse clients to your firm.

- Invest in a good workstation, even when working out of your home.

- Acquire necessary safety and security to storing private financial information, especially anti-virus, firewall, malware blocker, and encrypted holding facilities.

- Take coworking space, such as a rented room, to add more Accountants with different specialties to your firm to acquire more diverse clients.

- Use social media ads, such as Facebook and LinkedIn ads, to promote your firm.

- Make a website or start points of contact, such as a dedicated phone line or email, to help your clients reach out to you.

Read more: Can Engineers work from home?

Conclusion

Accounting is one of the well-paying jobs in the country, where over 2 million professionals are enjoying the benefits.

Therefore, becoming a remote Accountant may be the best career option you would have made.

However, remember to acquire the necessary qualifications, certificates, and exposure before working remotely.

Follow this guide to find insights about remote Accounting work and how to become successful.

Related Article: 17 Creative Home Office Ideas