Players must pay inheritance tax to the government in Bitlife if they die in a country with an estate tax.

The inheritance tax is the assets that players in Bitlife must give the government each time they die.

Continue reading this article to discover more about inheritance tax in Bitlife.

Table of Contents Show

What Is Inheritance Tax In Bitlife?

BitLife is a real-life simulation game available on various platforms where players live virtually from birth to death.

Whenever a player dies and a new child inherits, the player must pay the amount of assets to the government, known as the Inheritance Tax.

However, this tax amount varies based on the country where players reside in the game.

Moreover, if players stay in a country with an estate tax, they do not have to pay it.

Many players are often seeking advice to minimize or avoid the inheritance taxes within the game.

How To Minimize Inheritance Tax In BitLife?

To avoid Inheritance Tax in Bitlife, players have to follow the following steps:

Firstly, players should avoid countries having high estate taxes to keep their in-game assets financially strong.

Moreover, players must look for countries without estate taxes to maximize their income.

Australia, Austria, New Zealand, Norway, Panama, Canada, Estonia, and Hong Kong are some countries with no inheritance tax.

Building wealth faster and traveling to the tax free country can be other option.

Similarly, players can also sell assets before their death to lower inheritance tax in the game.

Best Countries To Avoid Tax In Bitlife

Players must bypass many countries in Bitlife to increase their assets during gameplay.

Some of the best countries to avoid tax are:

1. Saudi Arabia

In Bitlife, Saudi Arabia has a 0% tax rate, meaning when players die, 100% of their net worth will go to their kids.

2. Monaco

Monaco is another best country to avoid tax in Bitlife as Monoco also offers 0% estate and inheritance taxes.

However, the cost of living in Monaco is very expensive.

3. Norway

Norway has the highest wages, but the tax rate is slightly higher than other countries.

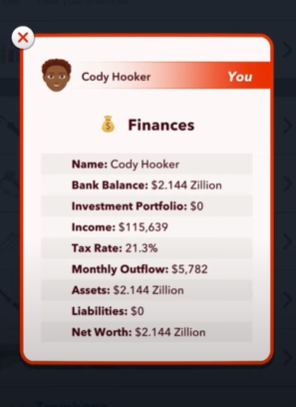

Similarly, Norway’s tax rate percentage can go up to 21.3%.

4. The Bahamas

The Bahamas has a moderate wage rate while the tax rate is 0%.

Moreover, the cost of living in The Bahamas is also very high.

The Bottom Line

Most BitLife players focus on minimizing inheritance tax by searching for estate tax-free countries.

You can also avoid the inheritance tax by living in countries like Australia, Austria, New Zealand, and Norway.

However, instead of avoiding inheritance tax while playing the game, players should enjoy it.